Financial Planning

-

How to Maximize Your Social Security Benefits

How Clients Can Maximize Their Social Security Benefits By Elaine Floyd, CFP® After being told for years not to count on Social Security, many baby boomers are making this government program the foundation of their retirement income plan. Why? Because it offers one of the best sources of retirement income—that is, inflation-adjusted income that continues for life. Most boomers will have other sources of income, of course, but none will be so reliable as Social Security. Once they figure out that the more they can get from Social Security, the less they will need to supply from their own assets, they start clamoring for information on how to maximize Social…

-

Road to Retirement

-

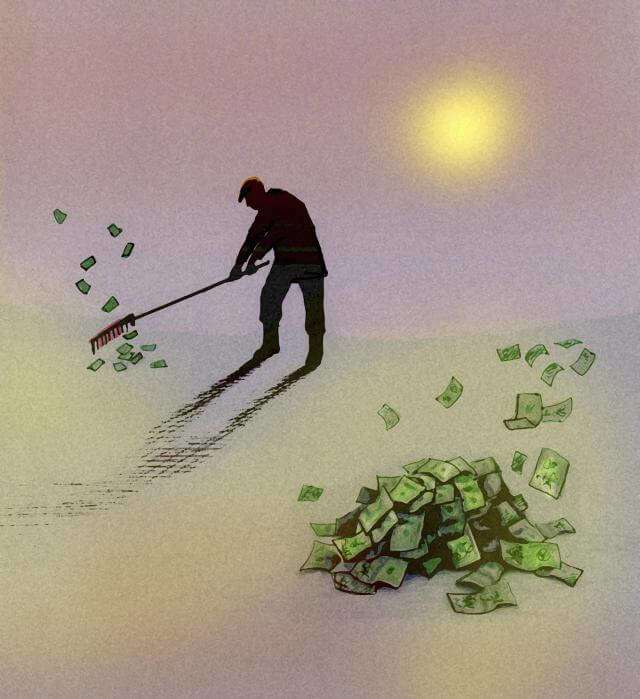

FINANCIAL FREEDOM

It’s closer than you think Do you have a mortgage, credit card debt and student or car loans? Are you on track to be in debt for the next 20—30 years or longer? Is debt weighing you down, and you feel like you will never get out of debt? You’re not alone. Many Americans today find themselves in a financial mess they did not plan for. But you don’t have to stay in this situation. There is a way out. It is possible to be completely out of debt—including your mortgage—in 9 years or less! It is possible to build a tax-free…